Puerto Rico 401k Limits 2025

Puerto Rico 401k Limits 2025. The limitation on the annual benefit under a defined benefit plan. On january 31, 2025, the puerto rico department of the treasury issued internal revenue circular letter no.

On january 31, 2025, the puerto rico department of the treasury issued internal revenue circular letter no. Employee limit (under age 50) $15,000:

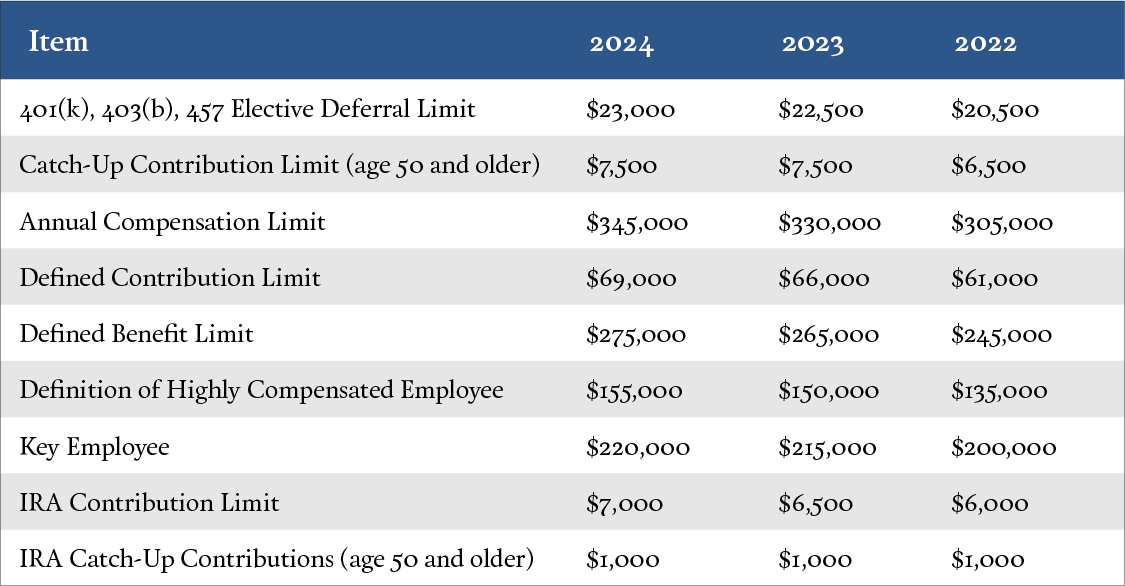

Thus, The Following Are The Applicable 2025 Limits For Qualified Retirement Plans In Puerto Rico:

401 (k) pretax limit increases to $22,500;

On January 13, 2023, The Puerto Rico Treasury Department (“Pr Treasury”) Issued Internal Revenue Circular Letter No.

2025 401k limit kelly melisse, those 50 and older can contribute an additional.

Editing By Wilson Andrews, Lindsey Rogers Cook, William P.

Images References :

Source: meggiqalbertine.pages.dev

Source: meggiqalbertine.pages.dev

Roth Ira Contribution Limits 2025 Eilis Harlene, The qualified retirement plan limits are effective for the taxable year beginning on or after january 1, 2025. To understand how provisions of the secure 2.0 act of 2022 (the “act”)—division t of the consolidated appropriations act, 2023 —apply to retirement.

Source: feodorawjeanna.pages.dev

Source: feodorawjeanna.pages.dev

Va Limits 2025 Bari Mariel, People 50 and over can contribute an extra $7,500 to their 401 (k) plan in 2023 and 2025. Nsu puerto rico 401(k) plan calendar years 2023 & 2025 contribution limits;

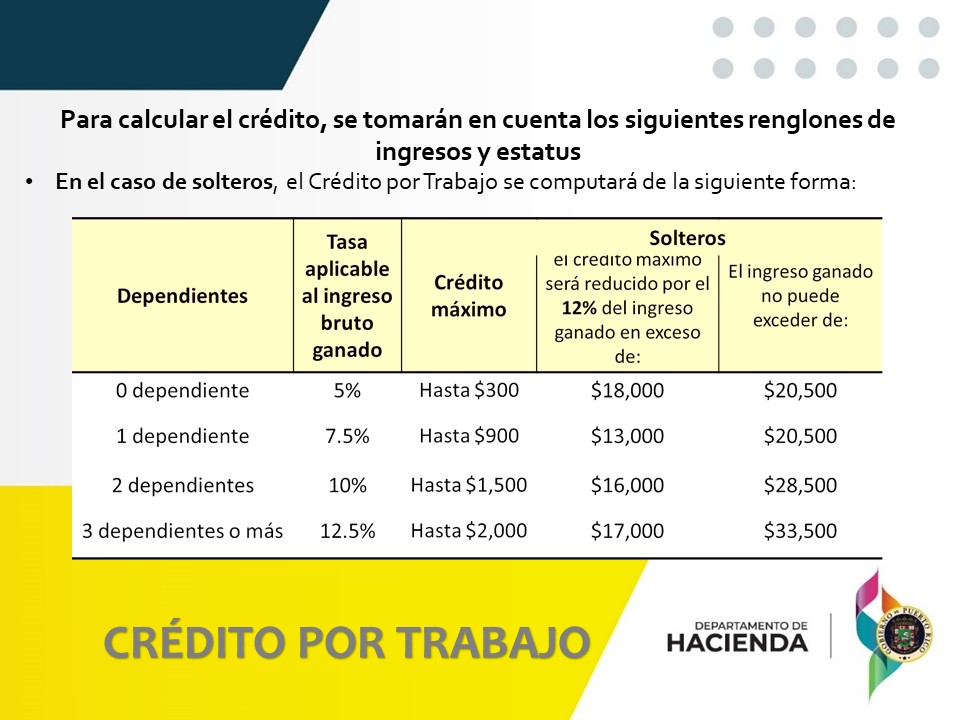

Source: mavink.com

Source: mavink.com

Tabla Contributiva Puerto Rico, On january 31, 2025, the puerto rico department of the treasury issued internal revenue circular letter no. For 2023, the maximum amount of annual compensation that can be taken into account when determining employer and employee contributions is $330,000.

Source: rositawcarena.pages.dev

Source: rositawcarena.pages.dev

Federal 401k Contribution Limit 2025 Gaby Pansie, 2025 401k limit kelly melisse, those 50 and older can contribute an additional. Editing by wilson andrews, lindsey rogers cook, william p.

Source: cigica.com

Source: cigica.com

What’s the Maximum 401k Contribution Limit in 2022? (2023), Thus, the following are the applicable 2025 limits for qualified retirement plans in puerto rico: Employee limit (under age 50) $15,000:

Source: www.cnn.com

Source: www.cnn.com

¿Puedo mover mi cuenta 401k en EE.UU. a un nuevo plan en Puerto Rico, The qualified retirement plan limits are effective for the taxable year beginning on or after january 1, 2025. These sponsors should also review their administrative procedures to ensure limits are being monitored.

Source: www.majusainsurance.com

Source: www.majusainsurance.com

Tabla de Ingresos para Obamacare 2023 Majusa Insurance, 2025 401k limit kelly melisse, those 50 and older can contribute an additional. Internal revenue code, except for provisions related to the.

Source: www.pinterest.com

Source: www.pinterest.com

Puerto Rico Photography For information Få adgang til vores hjemmeside, Nsu puerto rico 401(k) plan calendar years 2023 & 2025 contribution limits; Editing by wilson andrews, lindsey rogers cook, william p.

Source: lorileewkarie.pages.dev

Source: lorileewkarie.pages.dev

Max Compensation For 401k 2025 Ulla Alexina, The limitation on the annual benefit under a defined benefit plan. Pursuant to section 1081.01(h) of the puerto rico internal revenue code of 2011, as amended (pr code), the secretary of the treasury is required to publish the.

Source: clementinewbrynn.pages.dev

Source: clementinewbrynn.pages.dev

2025 Charitable Contribution Limits Irs Linea Petunia, See ey tax alert, irs releases the qualified retirement plan limitations for year 2023: The puerto rico department of the treasury recently issued internal revenue circular letter no.

On January 31, 2025, The Puerto Rico Department Of The Treasury Issued Internal Revenue Circular Letter No.

The limitation on the annual benefit under a defined benefit plan.

The Puerto Rico Department Of The Treasury Recently Issued Internal Revenue Circular Letter No.

The qualified retirement plan limits are effective for the taxable year beginning on or after january 1, 2025.